Introduction:

- Briefly introduce the concept of CPC and its importance in digital marketing.

- Mention why high CPC keywords can be lucrative for bloggers, website owners, and advertisers.

- Highlight how targeting these keywords can significantly increase ad revenue.

1. Insurance

- Example Keywords: “Best Car Insurance,” “Life Insurance Quotes”

- CPC Range: $50-$60+

- Content Strategy: Explain why insurance-related keywords have high CPC and how to create detailed guides or comparison posts that attract high-paying ads.

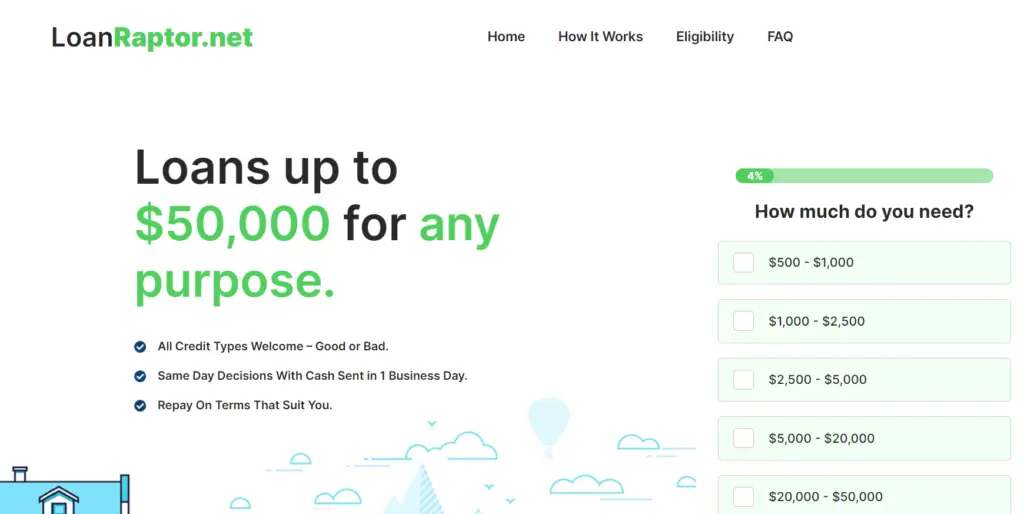

2. Loans

- Example Keywords: “Personal Loans for Bad Credit,” “Business Loan Calculator”

- CPC Range: $40-$50+

- Content Strategy: Discuss the high value of loan-related keywords and how to provide content that educates users about different types of loans, application processes, and financial tips.

3. Cryptocurrency

- Example Keywords: “Bitcoin Investment,” “Best Crypto Wallets”

- CPC Range: $30-$40+

- Content Strategy: Write about the latest trends in cryptocurrency, investment strategies, and reviews of trading platforms, which can attract high CPC ads.

4. Lawyer

- Example Keywords: “Personal Injury Lawyer,” “Divorce Lawyer Near Me”

- CPC Range: $20-$30+

- Content Strategy: Create content focused on legal advice, finding the right lawyer, or understanding legal processes, targeting specific niches within the legal industry.

5. Mortgage

- Example Keywords: “Mortgage Calculator,” “Refinance Mortgage Rates”

- CPC Range: $30-$40+

- Content Strategy: Develop content around mortgage tips, refinancing options, and how to secure the best mortgage rates.

6. Online Education

- Example Keywords: “Online MBA Programs,” “Best Online Courses”

- CPC Range: $20-$30+

- Content Strategy: Offer insights into online education, reviews of popular courses, or guides on how to choose the best online learning platforms.

7. Web Hosting

- Example Keywords: “Best Web Hosting Services,” “Cheap Web Hosting”

- CPC Range: $15-$25+

- Content Strategy: Write comprehensive reviews and comparisons of web hosting services, focusing on performance, pricing, and customer support.

8. Digital Marketing

- Example Keywords: “SEO Tools,” “Best Email Marketing Software”

- CPC Range: $10-$20+

- Content Strategy: Create content on the latest digital marketing trends, software reviews, and how-to guides for small businesses and entrepreneurs.

9. Credit

- Example Keywords: “Best Credit Cards,” “Credit Score Repair”

- CPC Range: $20-$30+

- Content Strategy: Focus on credit management, reviews of credit cards, and tips for improving credit scores.

10. Software

- Example Keywords: “Best Project Management Software,” “CRM Software”

- CPC Range: $10-$20+

- Content Strategy: Write in-depth reviews and comparisons of software tools, highlighting their features, pricing, and use cases.

Conclusion:

- Summarize the importance of targeting high CPC keywords.

- Encourage readers to carefully research and choose keywords relevant to their niche.

- Offer tips on optimizing content for these keywords to maximize revenue potential.

Call to Action:

- Invite readers to share their experiences with high CPC keywords.

- Suggest subscribing to your newsletter for more tips on boosting ad revenue.

This outline provides a solid foundation for an article that targets high CPC keywords, offering valuable content to readers while positioning your site for increased ad revenue.

4o

You said:

hello

ChatGPT said:

ChatGPT

Hello! How can I assist you today?

4o

You said:

Bitcoin Investment high cpc title

ChatGPT said:

ChatGPT

Here are some high CPC title ideas for an article about Bitcoin investment:

- “Maximize Your Returns: The Ultimate Guide to Bitcoin Investment in 2024”

- “Top 10 Bitcoin Investment Strategies for High Returns”

- “Is Bitcoin Investment Worth It? Expert Insights for 2024”

- “How to Safely Invest in Bitcoin: A Step-by-Step Guide”

- “Bitcoin Investment for Beginners: How to Get Started and Succeed”

- “The Future of Bitcoin Investment: Trends and Predictions for 2024”

- “Bitcoin Investment vs. Traditional Investments: Which Is More Profitable?”

- “Diversifying Your Portfolio: The Role of Bitcoin in Smart Investing”

- “Bitcoin Investment Risks and Rewards: What You Need to Know”

- “Expert Tips on Building Wealth Through Bitcoin Investment in 2024”

These titles are designed to attract readers interested in Bitcoin and investing, while also appealing to advertisers targeting high-value keywords.

4o

You said:

“Top 10 Personal Loans for Bad Credit: Your Guide to Fast Approval” artical

2/2

ChatGPT said:

ChatGPT

Certainly! Below is a draft for an article titled “Top 10 Personal Loans for Bad Credit: Your Guide to Fast Approval.”

Top 10 Personal Loans for Bad Credit: Your Guide to Fast Approval

Introduction

Navigating the financial world with a less-than-perfect credit score can be challenging, especially when you need a personal loan. However, having bad credit doesn’t mean you’re out of options. Many lenders specialize in providing loans to those with low credit scores, often with fast approval times. This guide will walk you through the top 10 personal loans for bad credit in 2024, helping you find the best options for your needs.

1. Avant

Overview: Avant is known for its quick and easy application process, catering to borrowers with credit scores as low as 580.

Loan Amounts: $2,000 – $35,000

APR: 9.95% – 35.99%

Pros:

- Quick approval and funding (often as fast as the next business day).

- Flexible repayment terms.

Cons:

- High APR for lower credit scores.

Why Choose Avant?

Avant is ideal for those looking for a straightforward, fast approval loan with a manageable repayment plan.

2. LendingPoint

Overview: LendingPoint focuses on borrowers with fair to poor credit, offering competitive rates and fast funding.

Loan Amounts: $2,000 – $36,500

APR: 7.99% – 35.99%

Pros:

- Same-day approval and funding.

- No prepayment penalties.

Cons:

- Origination fees may apply.

Why Choose LendingPoint?

LendingPoint is perfect for those who need quick access to funds and are looking to rebuild their credit.

3. OneMain Financial

Overview: OneMain Financial is a solid choice for those who prefer in-person service, with over 1,500 branches nationwide.

Loan Amounts: $1,500 – $20,000

APR: 18.00% – 35.99%

Pros:

- Available to borrowers with credit scores below 600.

- Secured and unsecured loan options.

Cons:

- Higher interest rates.

Why Choose OneMain Financial?

Choose OneMain if you prefer personal, face-to-face service and have a low credit score.

4. Upgrade

Overview: Upgrade offers personal loans with fast online approval, catering to those with fair to bad credit.

Loan Amounts: $1,000 – $50,000

APR: 8.49% – 35.99%

Pros:

- Free credit monitoring and financial education tools.

- Flexible repayment terms.

Cons:

- Origination fees up to 8%.

Why Choose Upgrade?

Upgrade is a great option if you want a fast online loan with added financial tools.

5. OppLoans

Overview: OppLoans specializes in helping those with poor credit, offering small loans with quick approval.

Loan Amounts: $500 – $4,000

APR: 59% – 199%

Pros:

- No minimum credit score requirement.

- Fast funding.

Cons:

- Extremely high interest rates.

Why Choose OppLoans?

Consider OppLoans if you need a small, fast loan and have been denied elsewhere due to poor credit.

6. NetCredit

Overview: NetCredit offers personal loans designed for borrowers with less-than-perfect credit, with flexible terms.

Loan Amounts: $1,000 – $10,000

APR: 34% – 155%

Pros:

- No prepayment penalties.

- Fast online approval.

Cons:

- High interest rates.

Why Choose NetCredit?

NetCredit is suitable for those looking for a quick, small loan despite having a low credit score.

7. BadCreditLoans.com

Overview: BadCreditLoans.com is an online platform that connects borrowers with lenders who are willing to provide loans despite bad credit.

Loan Amounts: $500 – $10,000

APR: Varies by lender.

Pros:

- No minimum credit score required.

- Easy online application.

Cons:

- Interest rates and terms vary widely.

Why Choose BadCreditLoans.com?

Choose this platform if you want to compare multiple offers from different lenders in one place.

8. Upstart

Overview: Upstart uses AI to assess your creditworthiness, making it easier for those with low credit scores to qualify.

Loan Amounts: $1,000 – $50,000

APR: 6.50% – 35.99%

Pros:

- Fast approval and funding.

- No minimum credit score required.

Cons:

- Origination fees up to 8%.

Why Choose Upstart?

Upstart is great if you have a thin credit file and want to be evaluated on factors beyond just your credit score.

9. CashUSA

Overview: CashUSA is another online lending network that connects borrowers with bad credit to lenders who can help.

Loan Amounts: $500 – $10,000

APR: 5.99% – 35.99%

Pros:

- Flexible loan terms.

- Easy online application.

Cons:

- Interest rates can be high depending on the lender.

Why Choose CashUSA?

Use CashUSA if you want to quickly compare loan offers from multiple lenders.

10. PersonalLoans.com

Overview: PersonalLoans.com is a lending network that offers a wide range of loan options for those with bad credit.

Loan Amounts: $1,000 – $35,000

APR: 5.99% – 35.99%

Pros:

- Wide range of loan amounts.

- Easy online application process.

Cons:

- Interest rates vary by lender.

Why Choose PersonalLoans.com?

PersonalLoans.com is ideal if you want to compare offers and have more flexibility in choosing your loan terms.

Conclusion

Getting a personal loan with bad credit may seem daunting, but it’s entirely possible with the right approach. The lenders and platforms mentioned above offer a variety of options tailored to those with low credit scores. By carefully reviewing your options and choosing a lender that aligns with your needs, you can secure the funds you need quickly and efficiently.

Tips for Fast Approval:

- Check Your Credit Report: Before applying, review your credit report to ensure there are no errors that could affect your approval chances.

- Consider a Co-Signer: Having a co-signer with good credit can increase your chances of approval and get you a better interest rate.

- Prepare Your Documents: Have your identification, proof of income, and bank statements ready to speed up the application process.

- Apply Online: Many lenders offer fast online applications with instant approval decisions.

Call to Action: If you’ve had success with any of these lenders or have tips for securing a personal loan with bad credit, share your experience in the comments below